|

Charlestown Township

|

The first business meeting for September was held September 4, 2012 at the Great Valley Middle School, Room 154, 255 N. Phoenixville Pike, Malvern, PA.

Present:

| Supervisors: | Frank A. Piliero, Chairman, Michael J. Rodgers, Vice Chairman, Kevin R. Kuhn, Charles A. Philips, Hugh D. Willig |

| Consultants: | Surender Kohli, P.E., Mark P. Thompson, Esq. |

| Staff: | Linda Csete, Manager, Jim Thompson, Roadmaster, Lisa Gardner, Recording Secretary |

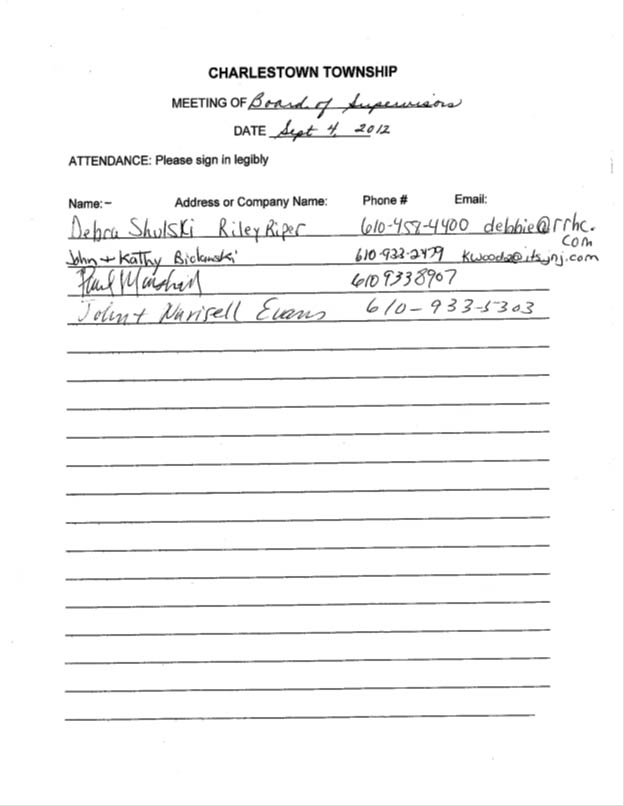

| Public: | See attached sign-in sheet |

Call to Order:

7:30 p.m.Announcements

– none.Citizens’ Forum

– No matters were brought forward.Approvals

Minutes of August 6, 2012 Business Meeting

Mr. Kuhn moved to approve the minutes of the August 6, 2012 business meeting and Mr. Rogers seconded. Mr. Piliero called for further discussion and there being none, called the vote. All were in favor.

Treasurer’s Report August 1 – 31, 2012

Mr. Rogers moved to approve the August 2012 Treasurer’s Report and Mr. Philips seconded. Mr. Piliero called for discussion and there being none, called the vote. All were in favor.

Accounts Payable Report September 4, 2012 Operating Fund

Mr. Kuhn moved to approve the September 4, 2012 General Fund Accounts Payable Report and Mr. Rogers seconded. Mr. Piliero called for discussion, and there being none, called the vote, and all were in favor.

Accounts Payable Report September 4, 2012 Open Space Fund

Mr. Philips moved to approve the September 4, 2012 Open Space Fund Accounts Payable Report and Mr. Kuhn seconded. Mr. Piliero called for discussion, and there being none, called the vote, all were in favor. Mr. Kuhn then noted the $10,600 figure for work performed on stormwater management basins in the Charlestown Brae development needed to come out of the Storm Water Management Fund instead of the Open Space fund. Mrs. Csete will reimburse the Open Space Fund this amount.

Reports

Mr. Rogers moved to accept the August reports #1-13 as submitted, and Mr. Philips seconded. Mr. Piliero called for further discussion, and there being none, called the vote. All were in favor.

Planning Commission

Mr. Michael Allen reported that he, Linda Csete and Dan Wright met on August 24th with Allan Meyers and PennDOT representatives to review the role the Township will be playing in obtaining the decorative signal and street light poles along the Route 29 corridor. Mr. Wright stated he is preparing a bid document for distribution near the end of the year. Then Mr. Allen stated, for budgetary considerations, that the contract is for 2 years. This length of time is due to the impact traffic will have on the project. Current plans reflect the Township providing poles and paying all costs upfront. The Township would then be reimbursed the difference in approximately 18 months. The developer would pay the balance. Mr. Allen foresaw a difficulty arriving at a finalized cost for budgetary concerns. Mr. Allen stated there may be a need to restructure the bid. Currently Charlestown Township is avoiding the markup PennDOT will instill, if taking responsibility of the pole bidding. Supervisors Kuhn and Philips both stated that they thought PennDOT was handling the bidding. This way the margin of error is much smaller and any errors made would not be costly to the Township itself. Mr. Willig stated the potential savings by Charlestown providing the poles vs. delegating bidding responsibilities was not worthwhile. Mr. Kuhn stated by letting PennDOT handle the bidding, the cost outlay would be closer to the project’s end. Mr. Allen stated PennDOT would be willing to take this responsibility and he would contact the representative. In addition, Mr. Allen said there were 70 incidental poles, not for lighting, that will be handled by a change order through PennDOT. These poles are to be breakaway poles to meet safety regulations. Mr. Kuhn stated the approved poles were to be black Unistrut, and that they did not need to be decorative.

Old Business - None

New Business

Improvements to Charlestown Cemetery Parking Area

Mrs. Csete said that the 2012 Budget included $5,000 for improvements to the Revolutionary War Cemetery parking lot, and asked the Board to determine whether they wanted to proceed. Mr. Kuhn has noticed a washed out area due to stormwater. Roadmaster Thompson offered to call PennDOT about this shoulder issue, and then he will further improve the area with a load of stone.

Bielawski Conditional Use Decision

Mr. Thompson asked for comments or questions from the applicants who then said they saw no problems with the conditions established in the draft Approval. Their proposed accessory two car garage would be in excess of 50% of the footprint of their existing home, at 2617 Charlestown Road in the R1 district. John Bielawski and Kathy Lynn Wood were told by Mr. Thompson that they would have 30 days to appeal the decision to the Court of Common Pleas or return to the Board of Supervisors for clarification. Mr. Wright assured Mr. Philips that the driveway stipulation requires gravel for storm water considerations. The owners are to submit to the Township a written document indicating they agree with the Approval’s conditions.

Mr. Willig moved to approve the decision as written, granting Conditional Use Approval to John Bielawski and Kathy Lynn Wood, and Mr. Philips seconded. Mr. Piliero called for discussion, and there being none, called the vote. All were in favor.

Zoning Hearing Board Application Overview – DeLage Landen Financial Services, 106 Charlestown Hunt Drive

Debra Shulski, representative for DeLage Landen Financial Services, provided an overview of her firm’s Zoning Hearing Board Application requesting a variance to allow for the expansion of a deck into the rear setback area. Ms. Shulski provided photos of the rear of the building that showed a wood lined yard area with a retaining wall. She stated the proposed wrap around deck already had HOA approval, would not extend beyond the wall, would not have an impact upon the neighbors, and would improve the marketability of the home for the future. The deck would be an expansion of 12 more feet, leaving 30 feet of setback remaining. Mr. Thompson and the Supervisors recognized this situation as a setback issue and took a neutral position on the application.

Fadness Property

Mr. Thompson began by proposing to file a civil complaint against the owner if the deadline of September 18th is not met. This is due to the inaction of the Fadnesses to re-establish the hedgerow that had been removed contrary to the property restrictions. Surender Kohli said he last met with the Fadnesses on August 29th and he did not believe resolution of all the open issues was being diligently addressed. Mr. Willig asked if the HOA could be responsible for the issue. Mr. Thompson said the re-establishment of the hedgerow was the responsibility of the individual owner, not the HOA. Daily fines would be imposed by the judge.

Mr. Piliero moved to proceed with enforcement by Mr. Thompson by filing a civil complaint and requesting the maximum penalties. Mr. Philips seconded. Mr. Piliero called for discussion, and there being none, called the vote. All were in favor.

Paul Marshall – Major Home Occupation

Mr. Marshall returned with information on his proposed use of part of his barn for operating a commercial kitchen and education center. Items to be addressed dealt with Sec. 27-1614.2C of the Zoning Ordinance regarding Standards for a Major Home Occupation. As previously requested by the Board Members, he returned to submit several key items. He submitted a parking diagram he previously discussed that outlines 22 spaces. He did not include any traffic impact data. However in an email dated August 31st he references a conversation with PennDOT’s representative, John Otten, his opinion being it would have insignificant impact. He stated he would hire 2 full-time employees.

Mr. Marshall’s vision is a “Farm to Table” educational and commercial kitchen, restaurant and a Sustainable Market business located at 2226 Charlestown Road. He also plans on working closely to educate at/with local schools. He would not be using his “dwelling” or home for this venture, or the apartment space in his barn. He would be using less than 25% of the space in his barn, an “accessory structure”. Improvements would include a ventilation hood, kitchen area and 2 farm tables. Supervisors maintained that a Major Home Occupation is stated to be in the “dwelling” per the Ordinance. Mr. Kuhn stated a “dwelling” is a “home”; a home is not a barn. Mr. Marshall’s restaurant styled education facility would be commercial and also not within his dwelling, therefore it did not fall under a Major Home Occupation, which was also Surender Kohli’s position. Mr. Marshall stated that since the barn had an apartment with people living in it, (before he purchased the multiple tax parcels and rejoined them by ownership,) that it had in fact been a “dwelling”. Mr. Willig determined it was still an “accessory structure” and not a dwelling.

Mr. Thompson clarified by stating that in Mr. Marshall’s zoning district, a commercial kitchen or educational usage is not allowed. It could be, if use was limited. Mr. Piliero noted the only use that changed since the last time Mr. Marshall addressed the board was the newly added “restaurant” wording.

Finally, Mr. Marshall requested further insight regarding dwelling restrictions, structures vs. dwellings, and overall direction from the Board of Supervisors as to what is required for this venture. The Board stated he needed a Variance from the Zoning Hearing Board for a commercial or business use. Also Mr. Thompson suggested he talk with a Land Use Attorney to help him comply with the Township’s ordinances. Mr. Piliero added it was important to follow the proper channels, so that everyone’s best interests would be met.

Brightside Farm Tenant Request

Mr. Piliero announced that Brightside farm tenants Tony and Marsha Wirtel are requesting release from their lease of the Brightside Farm house, which expires 7/31/13. They have purchased a home in the township and plan to vacate the house by 10/31/12. Mrs. Csete is to check the oil tank level and follow-up with Alix Coleman to request her oversight of the house once it’s vacant.

Mr. Piliero moved to release the Wirtels from the lease, Mr. Philips seconded. Mr. Kuhn called for discussion, and there being none, called the vote. All were in favor.

Minimum Municipal Obligation – Pension Plan

Mrs. Csete said the Township is required to vote each year to provide for the Minimum Pension Plan obligation in the next year’s budget. She indicated that a state grant of approximately $3,000.00 covers a portion of the cost.

Mr. Kuhn moved to authorize funding the Employee Pension Plan for 2013 in the amount of the Minimum Municipal Obligation provided by Trustees Insurance of $8,159 and to include this amount in the budget for 2013. Mr. Philips seconded. Mr. Piliero called for discussion, and there being none, called the vote, and all were in favor.

Pension Plan Resolution

Mrs. Csete explained that PSATS informed all municipalities that in order to comply with Act 44 of 2009, each municipality must adopt a resolution outlining the procedures for the procurement of professional pension services. A draft resolution had been provided by PSATS, which has been reviewed by Mr. Thompson and found to be acceptable for consideration of approval.

Mr. Kuhn moved to adopt Resolution #786-2012 establishing procedures for compliance with the professional services contract provisions of Act 44 of 2009, and Mr. Rodgers seconded. Mr. Piliero called for discussion. Mr. Willig called the vote, and all were in favor.

Sewage Facilities Planning Module for Blue Howell Properties LLCMr. Wright stated it was decided that the applicant would wait until the building permit applications for the individual lots to submit the planning modules.

Road Salt Bids Advertising

Mrs. Csete was directed to advertise the Road Salt Bid for 2012-2013 for opening on October 1, 2012.

Contract for Real Estate Tax Collection – Remainder of 2012

Mrs. Csete said the Township recently learned that the appointed Real Estate Tax Collector for 2012, Central Tax Bureau of PA, is going out of business, and has assigned all its collection contracts to Berkheimer for the remainder of 2012. As a result, Berkheimer has requested that each client officially appoint them as tax collector. Mr. Piliero asked Mr. Thompson to request a written contract from Berkheimer to confirm terms as done by Central Tax. Also, the bond with Central Tax needs to be changed to Berkheimer.

Mr. Philips moved to adopt Resolution #786-2012 appointing Berkheimer Tax Administrator as Real Estate Tax Collector for the remainder of 2012, and Mr. Kuhn seconded. Mr. Piliero called for discussion, and there being none, called the vote. All were in favor.

2013 Real Estate Tax Collection

Mrs. Csete said that as a result of Central Tax Bureau of PA going out of business, she requested proposals from Berkheimer Tax Administrator and Keystone Tax Collection Agency for the collection of 2013 Real Estate Taxes. She has received proposals from each agency and the results are as follows:

Berkheimer Tax Administrator – $2.25 per bill and $1.50 per reminder notice, plus postage

Keystone Tax Collection – $1.50 per bill and $.50 per reminder notice, plus postage

Mr. Piliero asked Mrs. Csete to contact Berkheimer and ask them to consider lowering their proposal. Also Mr. Rodgers requested she contact Keystone and ask for references.

Other Business - none

Adjournment

Mr. Piliero adjourned the meeting at 8:47 p.m. An Executive Session immediately followed. The next business meeting is scheduled for Monday, October 1, 2012, 7:30 p.m. at the Great Valley Middle School, Room 154, 255 North Phoenixville Pike, Malvern, PA.

Lisa Gardner

Recording Secretary